Printed Biodegradable Electronics in 2025: Transforming Sustainability and Performance in Next-Gen Devices. Explore How Green Tech is Reshaping the Electronics Landscape for the Coming Decade.

- Executive Summary: Key Trends and Market Drivers

- Market Size and Growth Forecast (2025–2030)

- Breakthrough Technologies in Printed Biodegradable Electronics

- Key Applications: From Medical Devices to Smart Packaging

- Major Players and Industry Initiatives

- Sustainability Impact and Regulatory Landscape

- Supply Chain and Materials Innovation

- Regional Analysis: Leading Markets and Emerging Hubs

- Challenges, Barriers, and Risk Factors

- Future Outlook: Opportunities and Strategic Recommendations

- Sources & References

Executive Summary: Key Trends and Market Drivers

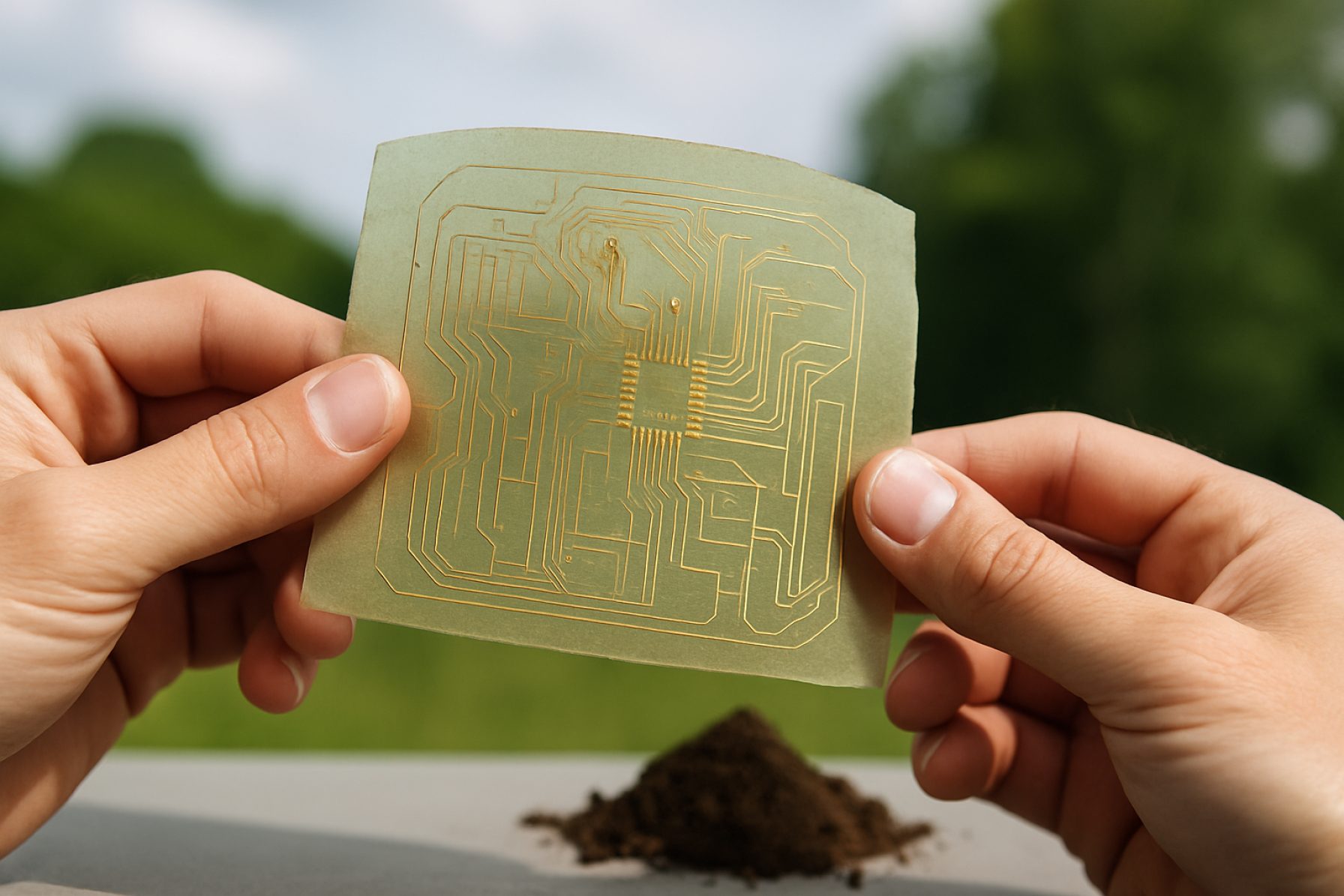

The market for printed biodegradable electronics is poised for significant growth in 2025 and the coming years, driven by mounting environmental concerns, regulatory pressures, and rapid advancements in materials science and printing technologies. As electronic waste (e-waste) becomes a critical global issue, the demand for sustainable alternatives to conventional electronics is accelerating. Printed biodegradable electronics—devices manufactured using eco-friendly, decomposable substrates and inks—are emerging as a promising solution to reduce the environmental footprint of electronic products.

Key trends shaping the sector include the development of novel biodegradable materials, such as cellulose-based substrates and organic semiconductors, which enable the fabrication of flexible, lightweight, and fully compostable electronic components. Companies like Sekisui Chemical and DuPont are actively investing in research and development of sustainable materials suitable for printed electronics, focusing on both performance and end-of-life degradability. Additionally, Novamont is recognized for its work in biodegradable polymers, which are increasingly being adapted for use in electronic applications.

The adoption of roll-to-roll printing and inkjet printing technologies is enabling scalable, cost-effective production of biodegradable electronic devices, including sensors, RFID tags, and smart packaging. Agfa-Gevaert is a notable player in the development of conductive inks and printing solutions tailored for sustainable electronics manufacturing. These technological advancements are lowering barriers to entry and facilitating the integration of biodegradable electronics into mainstream applications.

Regulatory frameworks in regions such as the European Union are also acting as catalysts, with directives targeting the reduction of hazardous substances and the promotion of circular economy principles. This regulatory momentum is compelling manufacturers and brands to seek greener alternatives, further boosting the prospects for printed biodegradable electronics.

Looking ahead, the outlook for 2025 and beyond is characterized by increased collaboration between material suppliers, technology developers, and end-users. Strategic partnerships and pilot projects are expected to accelerate commercialization, particularly in sectors such as smart packaging, environmental monitoring, and single-use medical devices. As the technology matures, the market is likely to witness broader adoption, supported by ongoing innovation and a growing emphasis on sustainability across the electronics value chain.

Market Size and Growth Forecast (2025–2030)

The market for printed biodegradable electronics is poised for significant growth between 2025 and 2030, driven by increasing demand for sustainable electronic solutions and regulatory pressures to reduce electronic waste. As of 2025, the sector remains in its early commercialization phase, but several key players and collaborative initiatives are accelerating its development. The market encompasses a range of products, including biodegradable sensors, RFID tags, batteries, and flexible circuits, primarily targeting applications in smart packaging, environmental monitoring, and medical diagnostics.

Major industry participants such as Sekisui Chemical and Novamont are investing in research and pilot-scale production of biodegradable substrates and inks suitable for printed electronics. Sekisui Chemical has developed cellulose-based films and substrates that are both printable and compostable, aiming to replace conventional plastics in flexible electronic circuits. Meanwhile, Novamont is advancing biopolymer formulations that can serve as the base for printed electronic components, with a focus on end-of-life compostability.

In 2025, the global market size for printed biodegradable electronics is estimated to be in the low hundreds of millions of US dollars, with projections indicating a compound annual growth rate (CAGR) exceeding 20% through 2030. This rapid expansion is attributed to the adoption of eco-friendly electronics in consumer goods, logistics, and healthcare. For example, Stora Enso, a leader in renewable materials, has launched pilot projects for paper-based RFID tags and sensors, targeting the smart packaging sector. Their solutions are designed to be fully recyclable and biodegradable, aligning with circular economy principles.

The European Union’s regulatory framework, including the Circular Economy Action Plan and restrictions on single-use plastics, is expected to further stimulate demand for biodegradable electronic components. Companies such as Stora Enso and Novamont are well-positioned to benefit from these policy shifts, given their established expertise in sustainable materials.

Looking ahead, the market outlook for 2025–2030 is characterized by increasing collaboration between material suppliers, printed electronics manufacturers, and end-users. As production scales up and costs decrease, printed biodegradable electronics are expected to penetrate high-volume applications, particularly in smart packaging and disposable medical devices. The sector’s growth will be further supported by ongoing innovation in biodegradable conductive inks and substrates, as well as by the commitment of leading companies to sustainability and circularity.

Breakthrough Technologies in Printed Biodegradable Electronics

The field of printed biodegradable electronics is experiencing rapid advancements, driven by the convergence of sustainable materials science and scalable manufacturing techniques. As of 2025, several breakthrough technologies are shaping the sector, with a focus on reducing electronic waste and enabling new applications in healthcare, environmental monitoring, and smart packaging.

One of the most significant developments is the use of organic and cellulose-based substrates for printed circuits. Companies such as Novamont and Stora Enso are pioneering the production of biodegradable materials suitable for electronic printing, leveraging their expertise in bioplastics and renewable fibers. These substrates are compatible with established printing techniques like inkjet and screen printing, allowing for the deposition of conductive inks made from biodegradable polymers or metal-organic compounds.

In 2025, the integration of biodegradable semiconductors and conductors has reached new milestones. For instance, Helian Polymers is advancing the development of polylactic acid (PLA)-based materials that can serve as both substrates and encapsulants for printed devices. Meanwhile, DuPont continues to expand its portfolio of conductive inks, including those formulated for compatibility with compostable substrates, supporting the creation of fully biodegradable electronic circuits.

A notable breakthrough is the commercialization of transient electronics—devices designed to dissolve or degrade after a predetermined operational period. Stora Enso has demonstrated printed RFID tags and sensors on cellulose-based substrates, targeting smart packaging and logistics applications where device lifespan is intentionally limited. These innovations are expected to scale further in the next few years, as demand for sustainable supply chain solutions grows.

In the medical sector, printed biodegradable sensors are being developed for temporary implants and wound monitoring. Companies like Novamont are collaborating with research institutions to create devices that safely degrade in the body, eliminating the need for surgical removal and reducing medical waste.

Looking ahead, the outlook for printed biodegradable electronics is promising. Industry leaders anticipate that by 2027, advances in material purity, device reliability, and mass-production techniques will enable broader adoption in consumer electronics, environmental sensing, and smart packaging. The sector is also expected to benefit from regulatory incentives and growing consumer demand for sustainable products, positioning printed biodegradable electronics as a key enabler of the circular economy.

Key Applications: From Medical Devices to Smart Packaging

Printed biodegradable electronics are rapidly transitioning from laboratory prototypes to real-world applications, driven by the convergence of sustainability imperatives and advances in materials science. In 2025 and the coming years, the most significant growth is expected in sectors where environmental impact, disposability, and cost-effectiveness are paramount—most notably in medical devices, smart packaging, and environmental sensors.

In the medical field, printed biodegradable electronics are enabling a new generation of transient devices designed to operate for a limited period before safely degrading in the body or environment. These include temporary sensors, stimulators, and drug delivery systems that eliminate the need for surgical removal. Companies such as STMicroelectronics are actively developing bioresorbable electronic components, leveraging organic semiconductors and biodegradable substrates to create devices that meet stringent biocompatibility standards. The outlook for 2025 includes pilot deployments of bioresorbable sensors for post-surgical monitoring and wound healing, with clinical trials expanding in Europe and Asia.

Smart packaging is another area witnessing accelerated adoption. Printed biodegradable circuits, antennas, and sensors are being integrated into packaging to enable real-time freshness monitoring, anti-counterfeiting, and interactive consumer engagement. Seeed Technology and Ynvisible Interactive are among the companies commercializing printed electronic labels and displays using compostable materials. In 2025, major food and pharmaceutical brands are expected to pilot smart labels that degrade alongside packaging waste, supporting circular economy goals and regulatory compliance on single-use plastics.

Environmental monitoring is also benefiting from the deployment of printed biodegradable sensors for air, water, and soil quality assessment. These devices can be distributed in large numbers and left in the environment without contributing to electronic waste. ams OSRAM is developing printed sensor platforms that combine low-cost manufacturing with eco-friendly materials, targeting applications in agriculture and urban infrastructure. Field trials in 2025 are anticipated to validate the performance and degradation profiles of these sensors under real-world conditions.

Looking ahead, the outlook for printed biodegradable electronics is shaped by ongoing material innovations, regulatory incentives, and growing end-user demand for sustainable solutions. As manufacturing processes mature and supply chains adapt, the next few years are likely to see broader commercialization, especially in high-volume, short-lifecycle applications where environmental impact is a critical consideration.

Major Players and Industry Initiatives

The landscape of printed biodegradable electronics in 2025 is shaped by a dynamic mix of established electronics manufacturers, innovative startups, and collaborative research initiatives. These players are driving the transition from traditional, non-degradable electronic components to sustainable, eco-friendly alternatives, with a focus on scalable manufacturing and real-world deployment.

Among the most prominent industry leaders, Seiko Epson Corporation stands out for its ongoing research and development in printed electronics, including efforts to integrate biodegradable substrates and inks into their product lines. The company’s expertise in precision printing technologies positions it as a key enabler for the mass production of flexible, environmentally benign electronic circuits.

In Europe, Novamont, a pioneer in bioplastics, has partnered with electronics manufacturers to supply biodegradable polymers suitable for printed circuit substrates. Their materials are increasingly being adopted in pilot projects for single-use sensors and smart packaging, reflecting a broader industry trend toward circular economy principles.

Startups are also playing a crucial role. Isorg, based in France, specializes in organic photodetectors and image sensors fabricated using printing techniques. The company is actively exploring biodegradable materials for next-generation sensor applications, particularly in medical diagnostics and environmental monitoring, where device end-of-life disposal is a critical concern.

On the collaborative front, the VTT Technical Research Centre of Finland is spearheading several EU-funded projects aimed at developing fully compostable printed electronics. VTT’s initiatives bring together material scientists, electronics manufacturers, and end-users to accelerate the commercialization of biodegradable RFID tags, smart labels, and disposable medical devices.

In Asia, FUJIFILM Corporation is leveraging its expertise in functional inks and printable electronics to develop biodegradable sensor platforms. The company’s R&D efforts are focused on integrating natural polymers and green solvents, with pilot-scale production lines expected to come online by 2026.

Looking ahead, industry analysts anticipate that the next few years will see a surge in partnerships between material suppliers, printing technology providers, and end-user industries such as healthcare, logistics, and consumer goods. The convergence of regulatory pressure, consumer demand for sustainability, and technological advances is expected to drive rapid adoption of printed biodegradable electronics, with major players like Seiko Epson Corporation, Novamont, and FUJIFILM Corporation at the forefront of this transformation.

Sustainability Impact and Regulatory Landscape

Printed biodegradable electronics are emerging as a promising solution to the growing problem of electronic waste (e-waste), which is projected to reach over 75 million metric tons annually by 2030. In 2025, the sustainability impact of these technologies is increasingly recognized by both industry and regulators, as they offer a pathway to reduce the environmental footprint of consumer electronics, packaging, and single-use sensors.

Key industry players are advancing the development and commercialization of biodegradable substrates, inks, and components. For example, Sekisui Chemical has developed cellulose-based films suitable for printed electronics, while Novamont is supplying biodegradable polymers for flexible circuits. Heinzel Group and Stora Enso are notable for their work in sustainable paper-based substrates, which are being adopted for printed RFID tags and smart packaging.

The regulatory landscape in 2025 is evolving rapidly. The European Union’s Circular Electronics Initiative, part of the European Green Deal, is pushing for stricter eco-design requirements and extended producer responsibility for electronics, incentivizing the adoption of biodegradable materials. The EU’s Waste Electrical and Electronic Equipment (WEEE) Directive is under review, with proposals to include specific targets for biodegradable and compostable electronics. In the United States, the Environmental Protection Agency (EPA) is supporting research and pilot projects for sustainable electronics, while several states are considering legislation to mandate compostable or recyclable components in certain categories of consumer electronics.

Industry consortia such as the FlexoGlobal and the OECD are facilitating knowledge exchange and standardization efforts, aiming to define criteria for biodegradability and end-of-life management of printed electronics. In Asia, Japan’s Ministry of the Environment is funding demonstration projects for biodegradable sensor networks in agriculture and logistics, reflecting a broader trend toward government-backed sustainability pilots.

Looking ahead, the next few years are expected to see increased collaboration between material suppliers, device manufacturers, and recyclers to establish closed-loop systems for printed biodegradable electronics. The sector faces challenges in scaling up production and ensuring performance parity with conventional electronics, but regulatory momentum and growing consumer demand for sustainable products are likely to accelerate adoption. By 2027, biodegradable printed electronics are projected to move from niche applications—such as smart packaging and environmental sensors—toward broader integration in consumer goods, driven by both policy and market forces.

Supply Chain and Materials Innovation

The supply chain for printed biodegradable electronics is undergoing rapid transformation as sustainability imperatives and regulatory pressures intensify in 2025. The sector is characterized by a shift from traditional petroleum-based substrates and inks to renewable, compostable, and non-toxic alternatives. Key materials include cellulose nanofibers, polylactic acid (PLA), and other biopolymers, as well as organic semiconductors and conductive inks derived from carbon or silver nanoparticles. This transition is being driven by both environmental concerns and the growing demand for eco-friendly electronics in applications such as smart packaging, single-use medical diagnostics, and environmental sensors.

Major players in the supply chain are investing in vertically integrated models to ensure traceability and quality of biodegradable materials. Seiko Epson Corporation has expanded its portfolio of printable, biodegradable substrates and inks, focusing on compatibility with high-throughput inkjet and screen printing processes. Agfa-Gevaert Group is developing water-based, biodegradable conductive inks tailored for flexible electronics, while Novamont is supplying biopolymer films that serve as substrates for printed circuits. These companies are collaborating with downstream device manufacturers to optimize material formulations for both performance and end-of-life degradation.

In 2025, supply chain resilience is a focal point, with manufacturers seeking to localize sourcing of biopolymers and cellulose to reduce carbon footprints and mitigate geopolitical risks. Partnerships between material suppliers and electronics manufacturers are accelerating the qualification of new biodegradable materials. For example, Stora Enso, a leader in renewable materials, is working with printed electronics firms to scale up the use of paper-based substrates for RFID tags and smart labels. Meanwhile, DuPont is advancing biodegradable conductive pastes and inks, targeting both consumer and industrial applications.

Looking ahead, the outlook for printed biodegradable electronics is promising, with pilot-scale production lines transitioning to commercial-scale output. The European Union’s Green Deal and similar regulatory frameworks in Asia and North America are expected to further stimulate demand for sustainable electronics components. However, challenges remain in balancing biodegradability with electrical performance and device longevity. Industry consortia and standards bodies are working to establish testing protocols and certification schemes to ensure that new materials meet both functional and environmental criteria. As a result, the next few years are likely to see increased collaboration across the supply chain, with a focus on innovation, scalability, and compliance.

Regional Analysis: Leading Markets and Emerging Hubs

The global landscape for printed biodegradable electronics is rapidly evolving, with significant activity concentrated in a few leading markets and several emerging hubs. As of 2025, Europe remains at the forefront, driven by stringent environmental regulations, robust R&D infrastructure, and strong governmental support for sustainable technologies. Germany, in particular, is a key player, with its established printed electronics sector and a growing focus on eco-friendly materials. Companies such as Heinze and research institutions are actively developing biodegradable substrates and inks, aiming to reduce electronic waste and support circular economy initiatives.

The Nordic region, especially Finland and Sweden, is also notable for its innovation in cellulose-based electronics. Finnish companies like VTT Technical Research Centre of Finland are pioneering the use of wood-derived materials for printed circuits and sensors, leveraging the region’s abundant forestry resources and expertise in sustainable materials science. These efforts are supported by national and EU-level funding, positioning the Nordics as a hub for green electronics innovation.

In Asia, Japan and South Korea are emerging as significant contributors, propelled by their advanced manufacturing capabilities and strong electronics industries. Japanese firms, including Fujifilm, are investing in the development of biodegradable substrates and printable conductive materials, targeting applications in flexible displays, smart packaging, and medical diagnostics. South Korea’s focus is on integrating biodegradable electronics into consumer devices and wearables, with support from major conglomerates and government-backed research programs.

The United States is witnessing growing interest, particularly in California and the Northeast, where academic institutions and startups are collaborating to commercialize biodegradable printed sensors and RFID tags. Organizations such as PARC, a Xerox Company, are exploring scalable manufacturing techniques and new material formulations, aiming to address both environmental concerns and the demand for low-cost, disposable electronics.

Looking ahead, the next few years are expected to see increased cross-border collaboration, with multinational consortia and public-private partnerships accelerating the commercialization of printed biodegradable electronics. Regulatory pressures, especially in the EU, are likely to drive adoption, while Asia’s manufacturing prowess and North America’s entrepreneurial ecosystem will contribute to scaling and diversification. As supply chains adapt and material innovations mature, regional hubs are poised to play complementary roles in shaping the future of sustainable electronics.

Challenges, Barriers, and Risk Factors

The advancement of printed biodegradable electronics in 2025 is marked by significant promise, but also by a complex array of challenges, barriers, and risk factors that must be addressed for widespread adoption. One of the primary technical challenges is the limited performance and stability of biodegradable materials compared to conventional electronic substrates and conductors. Biodegradable polymers and inks, while environmentally advantageous, often exhibit lower electrical conductivity, reduced mechanical robustness, and shorter operational lifespans. This restricts their use to low-power, short-duration applications such as disposable sensors, smart packaging, and temporary medical devices.

Material sourcing and standardization present further obstacles. The supply chain for high-purity, consistent biodegradable materials is still developing, with few large-scale suppliers able to guarantee the quality and reproducibility required for industrial-scale printing. Companies like Covestro and BASF are investing in biopolymer research, but the sector remains fragmented, and the lack of standardized material grades complicates process optimization and regulatory approval.

Manufacturing scalability is another significant barrier. While printed electronics benefit from roll-to-roll and inkjet processes, adapting these methods to biodegradable substrates introduces new complexities. Biodegradable films can be sensitive to heat, humidity, and solvents used in printing, leading to defects or inconsistent device performance. Equipment manufacturers such as NovaCentrix are developing low-temperature curing and sintering solutions, but these are not yet universally compatible with all biodegradable materials.

From a regulatory and environmental perspective, there is a lack of clear, harmonized standards for biodegradability and end-of-life management of electronic devices. Certification bodies and industry groups are only beginning to define what constitutes “biodegradable electronics,” and the risk of greenwashing remains high. Without robust certification, customers and regulators may be skeptical of environmental claims, slowing market acceptance.

Economic factors also play a role. The cost of biodegradable materials and specialized inks remains higher than traditional alternatives, and the return on investment is uncertain for many manufacturers. This is particularly relevant for sectors like consumer electronics, where cost pressures are intense. Furthermore, the integration of biodegradable components with conventional electronics in hybrid devices introduces additional complexity in recycling and waste management.

Looking ahead to the next few years, the sector’s outlook will depend on continued material innovation, the establishment of supply chains, and the development of industry-wide standards. Collaboration between material suppliers, equipment manufacturers, and end-users—such as those fostered by FlexEnable and Heliatek—will be critical to overcoming these barriers and realizing the full potential of printed biodegradable electronics.

Future Outlook: Opportunities and Strategic Recommendations

The outlook for printed biodegradable electronics in 2025 and the following years is marked by accelerating innovation, expanding market opportunities, and strategic imperatives for stakeholders across the value chain. As environmental regulations tighten and consumer demand for sustainable products grows, the sector is poised for significant growth, particularly in applications where short device lifespans and minimal environmental impact are critical.

Key opportunities are emerging in sectors such as smart packaging, single-use medical diagnostics, environmental sensors, and agricultural monitoring. Printed biodegradable sensors and RFID tags are gaining traction as alternatives to conventional electronics, reducing electronic waste and enabling new business models in logistics and supply chain management. For example, companies like Stora Enso are actively developing eco-friendly RFID and NFC solutions using renewable materials, targeting the packaging and retail industries. Similarly, Ynvisible Interactive is advancing printed electrochromic displays and sensors on biodegradable substrates, aiming at smart labels and disposable diagnostics.

Material innovation remains a strategic focus. The development of conductive inks based on organic polymers, cellulose nanomaterials, and other biodegradable compounds is expected to accelerate, driven by collaborations between material suppliers and device manufacturers. Novamont, a leader in bioplastics, is exploring partnerships to supply biodegradable substrates for printed electronics, while Helian Polymers is working on biopolymer formulations suitable for electronic printing processes.

Strategically, companies are advised to invest in R&D for scalable printing techniques—such as roll-to-roll and inkjet printing—that are compatible with biodegradable materials. Establishing robust supply chains for bio-based inks and substrates will be crucial. Partnerships with end-users in healthcare, food, and logistics can accelerate adoption by co-developing application-specific solutions. Furthermore, engaging with regulatory bodies and industry consortia to shape standards for biodegradability and electronic waste management will help ensure market access and compliance.

Looking ahead, the sector is expected to benefit from increased funding and pilot projects, particularly in Europe and Asia, where sustainability initiatives are driving public and private investment. As performance and cost competitiveness improve, printed biodegradable electronics are likely to transition from niche applications to broader commercial deployment by the late 2020s. Companies that prioritize eco-design, supply chain integration, and cross-sector collaboration will be best positioned to capture emerging opportunities in this rapidly evolving landscape.

Sources & References

- Sekisui Chemical

- DuPont

- Novamont

- Helian Polymers

- STMicroelectronics

- Seeed Technology

- Ynvisible Interactive

- ams OSRAM

- VTT Technical Research Centre of Finland

- FUJIFILM Corporation

- Heinzel Group

- PARC, a Xerox Company

- Covestro

- BASF

- NovaCentrix

- FlexEnable

- Heliatek